17 Min Read

You’ve poured years—maybe even decades—into building your practice. Long hours, patient trust, and a level of dedication only few can understand. Now, you’re thinking of selling. But do you know what’s ahead?

Most doctors don’t. And that’s the problem.

Selling a healthcare practice isn’t like selling a retail business or a tech startup. This isn’t about handing over a storefront or an app. This is your legacy. Your reputation. Your financial future.

Yet, most practice owners make serious, irreversible mistakes that cause them to leave hundreds of thousands—sometimes millions—of dollars on the table.

They:

- Accept lowball offers without knowing their real practice value.

- Sign restrictive contracts that trap them in unfavorable terms.

- Lose control over patient continuity and staff retention.

- Fail to leverage the market correctly—selling at the wrong time, to the wrong buyer.

- Ignore the hidden risks buried in legal and compliance obligations.

And the worst part? Most doctors only realize these mistakes after it’s too late.

If you’re even considering selling—whether a full sale or just a portion—you need to know this: The market is shifting, and waiting too long could cost you everything.

You’ve heard the industry buzz—private equity firms, individual buyers, silent investor groups—all looking to acquire healthcare practices. But what no one tells you is that they are highly selective. They don’t want just any practice, they want investment-grade ones.

According to the American Antitrust Institute, private equity (PE) firms have been increasingly acquiring physician practices across several physician specialties since 2012, increasing from 75 deals in 2012 to 484 deals in 2021, or more than a six-fold increase in only 10 years.

Is your practice investment grade? If you don’t know the answer, you’re already behind.

The good news? With the right strategy, positioning, and negotiation tactics, you can sell for top dollar and maintain control over your future.

This blog post will show you:

- How to get competitive, high-value offers—without exposing your intentions too soon.

- How you can avoid the legal and financial traps that cost doctors their retirement security.

- How to maintain your professional autonomy, even after a sale.

- How to structure the deal so that you walk away with maximum financial gain.

Selling your healthcare practice is one of the most critical financial decisions of your life. Do it right, and you secure your future. Do it wrong, and you risk losing everything you worked for.

You owe it to yourself to be fully informed before making your next move. The market is changing, and the window of opportunity won’t stay open forever.

The time to act is now. Let’s get started.

Before We Begin: The Cost of “Winging It” — A Doctor’s Story

Dr. James Carter thought he had it all figured out. Three decades of running a successful practice, a solid reputation, and patients who trusted him. When it was time to sell, he assumed it would be straightforward.

He was wrong.

Dr. Carter wasn’t reckless. He wasn’t careless. He simply didn’t know what he didn’t know.

And that cost him everything.

The Reality of Selling Without a Plan

Dr. Carter made the same costly mistakes many doctors make when selling:

- He assumed he was getting a fair deal. He never got a professional valuation, so he had no idea what his practice was truly worth. The buyer did—and they took full advantage.

- His financial records weren’t investor-ready. His business and personal expenses were mixed, making the numbers look messy and unappealing. Investors saw risk—and lowered their offers.

- He trusted the buyer without verifying their financial strength. The deal stalled for months because the buyer didn’t have the funds ready.

- He signed a legally weak contract. Without a healthcare-specific attorney, he agreed to terms that later worked against him. Regret came fast.

- He didn’t plan for patient and staff transitions. Within months, his loyal team was gone, and patients complained about declining care.

What Happened Next?

- He sold for 30 percent less than market value.

- Legal issues drained his retirement savings. Health Insurance Portability and Accountability Act (HIPAA) data transfer violation led to unexpected penalties.

- The deal structure triggered excessive taxes. Without a tax strategy in place, he lost even more money post-sale.

- Within six months, he regretted everything. His name was still attached to a practice that was falling apart.

Why This Happens—And How You Can Avoid It

Selling your healthcare practice isn’t just about finding a buyer. It’s about protecting your financial future, your reputation, and the legacy you built.

Yet, many doctors think:

- “I’ll figure it out as I go.”

- “My accountant or general attorney will handle it.”

- “Any buyer is a good buyer.”

None of these assumptions are true. And the consequences? Permanent.

The Right Way of Selling Your Healthcare Practice—Without Losing Everything

Dr. Carter’s story is a warning. You don’t get a second chance at selling your practice.

If you want to:

- Sell at full market value—or higher.

- Avoid legal and financial traps.

- Ensure a smooth patient and staff transition.

- Walk away without regrets.

Then you need a plan.

What does that plan look like?

Let’s break it down—step by step.

The 7 Critical Steps to Selling Smart—Not Sorry

Most doctors assume selling their practice is just a matter of finding a buyer and signing a contract. They couldn’t be more wrong.

Dr. Michael Hayes almost made that mistake. A successful cardiologist with a thriving practice, he assumed selling would be straightforward. But he quickly realized buyers had the upper hand—his financials weren’t airtight, his contracts had hidden risks, and his valuation was completely off.

One wrong step, and he would have signed away his life’s work for a fraction of what it was worth.

He didn’t make that mistake. Will you?

You have one shot to do this right. There are seven non-negotiable steps to selling your practice for maximum value, minimum stress, and zero regrets. Skip even one, and you’re leaving money—and control—on the table.

Let’s break them down—before it’s too late.

Step 1: Business Valuation – What is Your Practice Really Worth?

Dr. Michael Hayes thought he knew exactly what his practice was worth. After all, his colleague sold a similar practice for a hefty sum just last year. Surely, he could expect the same—or more.

Wrong.

When the offers started coming in, Dr. Hayes was shocked. Some were insultingly low. Others seemed decent—until he looked at the fine print and realized they came with restrictive clauses and long earn-out periods that would keep him locked in for years.

What went wrong? He relied on assumptions instead of facts.

Three Ways Buyers Value a Medical Practice:

Dr. Hayes quickly learned that buyers don’t care about what another doctor sells for. They use real financial metrics to determine value. And if you don’t know how your practice stacks up, you’re negotiating blind.

- EBITDA Multiples – What Private Equity Cares About

Big investors don’t buy “jobs”—they buy businesses that generate profit even when the owner steps away. They use EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to measure profitability. If your practice isn’t structured to maximize EBITDA, you’re already losing money before negotiations even begin. - Revenue-Based Valuation – The Trap Many Doctors Fall Into

Some buyers will dangle a revenue multiple as a valuation method. It sounds simple, but here’s the catch—if your expenses are high, your take-home is low. A 2x revenue multiple might look good at first, but if your profitability isn’t strong, it’s a bad deal. - Asset-Based Approach – When Real Estate and Equipment Matter

If Dr. Hayes had a heavy investment in equipment and technology or even owned his office building, he needed a valuation that factored these in properly. Some buyers only care about assets—meaning they might dismiss future growth potential, leading to an undervaluation.

The Wake-Up Call

Dr. Hayes finally did what he should have done from the start—hired a professional practice valuation expert. And what he found out stunned him. His gut feeling was off by 35 percent. If he had gone with his initial assumptions, he would have walked away with far less than his practice was truly worth.

Your practice isn’t just a number. It’s a combination of profitability, assets, scalability, and market demand. If you don’t know how the right buyers calculate value, you will lose.

Before you even think about selling, ask yourself: Do you know what your practice is worth? Or are you just guessing?

Dr. Hayes stopped guessing—and it saved him hundreds of thousands of dollars. Will you make the same mistake? Or will you take control of your valuation before it’s too late?

Step 2: Preparing Financials – Make Them Buyer-Ready

Dr. Hayes thought he was finally on track. After getting a proper valuation, he was confident his practice was worth top dollar. But then came the due diligence process—and reality hit hard.

His practice’s financial documentation was a mess.

The first buyer took one look at his books and walked away. The second buyer offered significantly less than expected. Why? Because Dr. Hayes failed to present clear, verifiable proof that his practice was truly profitable.

Buyers don’t make decisions based on hope—they need hard numbers.

What Buyers Scrutinize—And What Dr. Hayes Overlooked

- Profit & Loss Statements (Last 3 Years)

Dr. Hayes had financials, but they weren’t organized. Some expenses were miscategorized, and personal costs were mixed in. Buyers want clean, transparent records—not excuses. - Balance Sheets Minus Hidden Debts Equals Deal Killers

The buyer’s team quickly spotted liabilities that Dr. Hayes didn’t even think about—outstanding loans, unpaid vendor balances, and lease obligations. Every dollar of hidden debt is a dollar off your practice’s value. - Tax Returns: No Hiding from the IRS or Buyers

Dr. Hayes had taken aggressive tax deductions over the years, minimizing his reported income. Smart for taxes? Maybe. Smart for selling? Absolutely not. Buyers use tax records to verify revenue—and when they don’t match up with financial statements, they lose trust. - Revenue Sources – Is Your Income Too Risky?

One of the biggest red flags? Dr. Hayes had 70% of his revenue coming from a single insurance provider. Buyers saw this as a massive risk—if that payer changed reimbursement policies, the entire practice could collapse. Diversity matters.

The Wake-Up Call

Dr. Hayes learned the hard way that messy financials lead to undervalued offers—or worse, no offers at all. It took him six months to clean up his records, fix inconsistencies, and ensure his numbers were airtight.

If he had done this from the start, he could have closed a deal months earlier—and for far more money.

Selling a practice isn’t just about what you think it’s worth. It’s about what you can prove it’s worth. Dr. Hayes fixed his mistake. Will you? Or will you let disorganized financials sabotage your exit strategy?

Step 3: Legal & Compliance Checklist: Landmines That Can Kill Your Deal

Dr. Hayes finally had his financials in order, but just as he thought he was ready to sell, another obstacle surfaced—legal and compliance nightmares.

The first serious buyer requested a compliance audit before finalizing the deal. Within days, problems started piling up.

- HIPAA Violations – A Silent Deal Killer: Dr. Hayes had never conducted a formal HIPAA risk assessment. His patient data storage was outdated, and some records weren’t properly encrypted. The buyer flagged this as a major liability—any breach could mean fines, lawsuits, and even criminal penalties. They walked away.

- Employment Contracts & Non-Competes – A Legal Mess: Dr. Hayes had zero enforceable non-compete agreements with his associates. Worse, a former employee had recently opened a competing clinic just a few miles away. Buyers want protection from key staff taking patients with them—but without legal safeguards, Dr. Hayes’ practice looked like a risky investment.

- US GAAP Compliance: Dr. Hayes’ financials weren’t fully aligned with US GAAP—revenues were inconsistently recorded, expenses were misclassified, and key financial records missing. The buyer saw this as a major red flag. Inaccurate financials meant potential legal risks and hidden liabilities. They walked away.

The Wake-Up Call

By the time Dr. Hayes hired a healthcare attorney to clean up these issues, weeks had passed, and the best buyer was gone. He lost time and money—all because he failed to handle legal and compliance risks upfront.

Don’t make the same mistake. Before listing your practice, get a legal audit. Buyers don’t take risks, and neither should you.

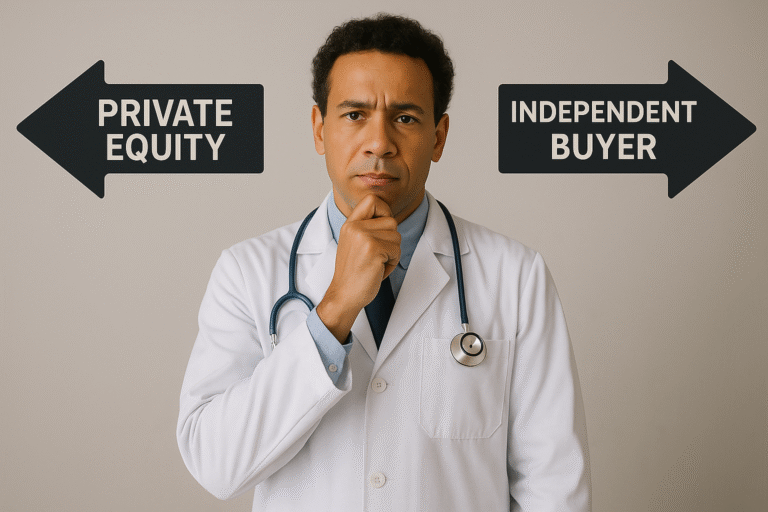

Step 4: Finding the Right Buyer—It’s Not Just About the Highest Bid

Dr. Hayes thought he was finally in the clear. His financials were solid, compliance issues were handled, and buyers were showing interest. But then came the biggest mistake yet—assuming that the highest offer was the best offer.

The Wrong Buyer = A Nightmare Sale

His first serious offer came from a private equity group promising a massive payday. But after reviewing the fine print, he realized their plan: slash costs, overhaul operations, and force out existing staff. If he sold to them, his practice—the one he spent decades building—would become unrecognizable within a year.

Next, a local hospital group made an offer. It was stable, and they had the funding. But their contract had one critical flaw—they wanted complete control over Dr. Hayes’ remaining years at the practice. He would lose all autonomy, forced to follow their protocols with no say in patient care.

Then there was a fellow physician interested in maintaining the practice’s legacy. It seemed like the ideal solution—until financing became an issue. Unlike private equity or hospitals, individual doctors often struggle to secure funding for a buyout. Deals fall apart. Promises get broken.

The Wake-Up Call

Dr. Hayes learned the hard way: choosing the wrong buyer can be worse than not selling at all.

He finally took a strategic approach—vetting buyers based on more than just money. He considered culture fit, transition plans, and long-term stability.

The lesson? Don’t just chase the highest bid. The wrong buyer can destroy your practice’s reputation, alienate your staff, and leave you full of regret.

Step 5: Negotiating the Deal – Getting the Best Price & Terms

Dr. Hayes had a solid offer on the table, but he made one critical mistake—he didn’t negotiate. He assumed the buyer’s first proposal was fair. It wasn’t.

Leverage = Power

At first, he entertained only one buyer. That buyer knew it—and offered a significantly lower price. When Dr. Hayes finally got competing offers, suddenly, the original buyer increased their bid by 15%. Lesson? More buyers = more power.

Then came the deal structure trap. The buyer pushed for a stock sale—a move that favored them but increased Dr. Hayes’ tax burden significantly. With expert guidance, he renegotiated for an asset sale instead, keeping more money in his pocket.

The Earn-Out Danger

The buyer also proposed an earn-out—promising future payments only if the practice hit certain revenue targets. Sounds good, right? Wrong. No guarantee. No control. If the new owner mismanaged the practice, Dr. Hayes could kiss that money goodbye.

By understanding deal structures, creating competition, and rejecting risky terms, Dr. Hayes walked away with the best price—and the best terms.

Selling isn’t just about what you get upfront. It’s about protecting yourself long after the deal closes.

Step 6: Due Diligence – The Most Stressful Part (Unless You’re Prepared)

Dr. Hayes thought the hardest part was over when he accepted an offer. He was wrong. The buyer’s due diligence team picked apart every detail of his practice—financial records, legal compliance, patient contracts, and employee agreements. One missing document or red flag could kill the deal.

The buyer questioned inconsistent revenue records. Dr. Hayes scrambled to explain. They found an outdated employee contract. More delays. Every mistake cost him time, leverage, and nearly the sale.

According to a survey done by Bain and Company, almost 60% of executives attributed deal failure to poor due diligence that did not identify critical issues.

Just having the right documents isn’t enough. They need to be organized, centralized, and instantly accessible. A disorganized process makes you look unprepared—and buyers hate uncertainty.

Had he organized clean financials, reviewed contracts, and fixed compliance issues upfront, he could have controlled the process instead of reacting to it.

Smart sellers prepare everything before listing. The smoother the due diligence, the faster—and more profitable—the sale.

Step 7: Closing the Sale—What Happens After You Say “Yes”?

You’ve agreed to the deal. Now comes the real work. Closing isn’t just about signing a contract—it’s about protecting your future and ensuring the transition goes smoothly. Without the right planning, everything can fall apart.

The Legal Steps You Can’t Afford to Miss

Contracts, tax implications, and transition agreements. If any of these are overlooked or mishandled, you’ll be stuck with a mess you didn’t plan for. Review everything—carefully. A single error could cost you financially or legally.

Transition Planning: The Key to Success or Failure

Now, how do you tell your staff and patients? If you don’t have a clear communication plan, prepare for chaos. What’s the message? How will patient care continue? Who manages the transition? If you don’t set the right expectations, your loyal staff might walk, and your patients could leave in droves.

And the most important question—What’s next for you? Have you planned for life after the sale? If you haven’t considered your next chapter, you’ll be left scrambling.

This is your last chance to ensure a smooth exit, and it’s non-negotiable. Don’t let it slip away. Make sure you’re not the one who regrets this decision. Act now before it’s too late.

The Exit Door Is Closing

This is it. You’re at a crossroads. Sell your practice the right way, and you walk away with the financial security you deserve, a seamless transition, and your reputation intact. Do it wrong and you’ll be left with regret, financial losses, and a nightmare that haunts you long after the ink dries on a bad deal.

According to a report by the Physicians Advocacy Institute, nearly four of five physicians (77.6%) are now employees of hospitals/health systems and other corporate entities reflecting a significant shift from independent practice ownership.

Which future do you want? You have one shot at this.

You don’t get a second chance to make a first impression. Once a buyer starts peeling back the layers of your practice, they’re looking for one of two things: proof that you’re a seamless, low-risk acquisition or a reason to pull out.

And trust us, if they want to find something wrong, they will.

So, what happens when they uncover a compliance issue you overlooked? Or when your financial documentation raises more questions than provides answers? What if a missing contract delays the deal by months, giving the buyer cold feet?

Time kills deals. And every delay, every red flag, every unanswered question costs you money, leverage, and credibility.

But here’s the reality: You don’t have to do this alone.

Enter DiligenceSure—your secret guide to selling your practice without the nightmare of due diligence chaos. It’s not just a tool; it’s your insurance policy against deal failure. It eliminates guesswork, streamlines every document, flags potential issues before buyers find them, and positions your practice as a bulletproof investment.

The result? A smooth, fast, and highly profitable sale.

The difference between walking away with maximum value or walking away with regrets comes down to preparation. The market is moving. Buyers are looking. But if you’re not ready, someone else will take your place.

So, what’s it going to be? Will you take control of your future, lock in your deal, and secure your legacy? Or will you hesitate—only to watch the opportunity pass you by?

The choice is yours. But remember—only those who are prepared win.