10 Min Read

Imagine this.

You’ve spent 25 years building your medical practice—long nights, early mornings, endless paperwork, patient care that went above and beyond. You’re ready to move on. Retirement, new ventures, a slower pace—it’s time.

You list the practice. You expect serious offers, and they come (kind of).

Three months pass, then six. You’re still fielding “interest,” but no one’s biting. One buyer wants a massive discount. Another can’t get financing. A private equity group ghosts you. Meanwhile, the overhead doesn’t stop. Staff morale dips, and your energy fades.

Here’s what no one tells you when you first think of selling:

It’s not just about finding a buyer. It’s about structuring a deal that gets the right buyer across the finish line—fast, safely, and profitably.

In today’s market, one tool makes that possible: seller financing.

The vast majority of small business sales — 80%, according to industry statistics, include some form of seller financing.

This blog post isn’t here to give you the basics. It’s here to wake you up, to show you how seller financing can be the very thing that saves your deal, boosts your earnings, and secures your legacy. Also, ignoring it can be the reason your practice never sells.

What Is Seller Financing—And Why Is It Taking Over the Market?

Let’s break it down.

Seller financing means you, the seller, agree to finance a portion of the purchase price. Instead of demanding 100% cash upfront, you let the buyer pay a down payment now and the rest over time with interest.

Think of it like this: You become the bank, but smarter.

Sounds risky? Only if you do it wrong (we’ll cover that). When structured correctly, this is one of the most powerful tools at your disposal.

And here’s why it’s becoming unavoidable:

- Traditional bank financing is tighter than ever.

- Buyers—especially younger doctors and small groups—are cash-strapped but serious.

- Private equity firms want flexibility and speed.

- The top-performing sellers? They’re offering structured financing—and they’re closing faster, for more money.

Still think all-cash is the gold standard?

The all-cash buyer is a unicorn. You can wait for them. Or you can create a deal that attracts 90% of qualified buyers who just need a smarter structure.

Why Seller Financing Is No Longer Optional If You Want a Premium Exit

Let’s imagine two sellers: Dr. A and Dr. B.

Both run identical practices—same patient base, same revenue, same location.

Dr. A insists on an all-cash deal. She believes seller financing is “desperate.” She waits 14 months, cuts her asking price by 20%, and still barely finds interest.

Dr. B? She offers a seller-financed option with a 30% down payment, a 5-year repayment plan at 6% interest, and tight legal protections. She closes in 90 days, with a 15% premium over the market.

Guess who’s smiling in retirement?

This is the cold truth: Today’s buyers have options. You don’t have time.

Buyer psychology favors flexibility. The more you help them get to the finish line without sacrificing your interests, the more attractive your practice becomes.

Would you rather wait 18 months hoping for a fantasy buyer or close in 90 days with a vetted, committed one who just needs a smarter path to ownership?

Seller financing makes you the guide. Not the gatekeeper. That’s the difference.

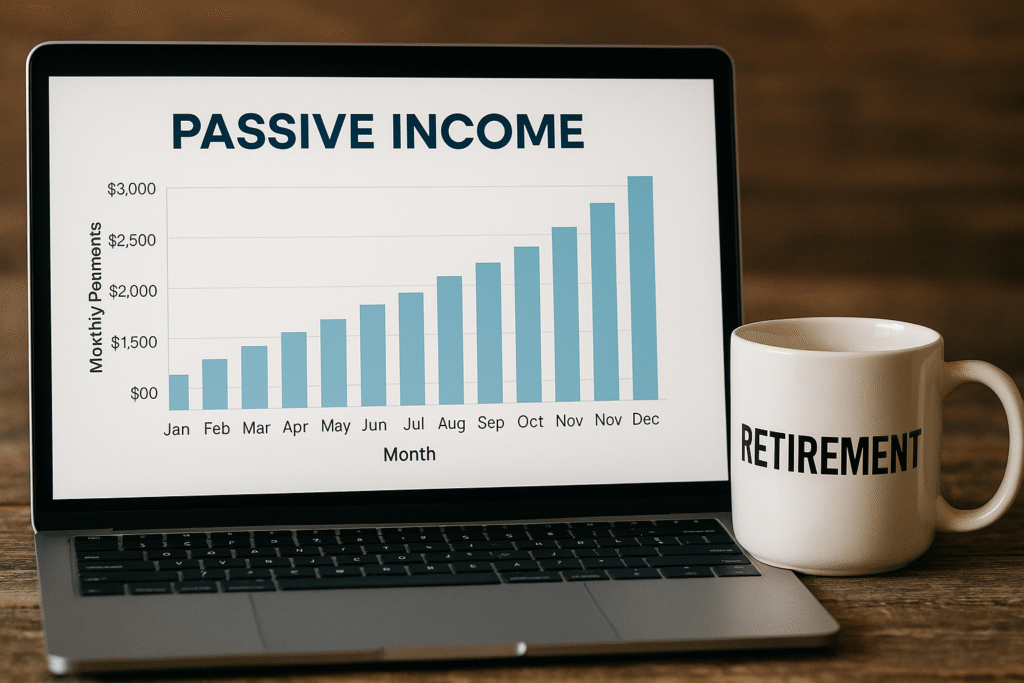

How Seller Financing Can Make You More Money (Not Less)

Let’s do the math.

You receive an all-cash offer for $1.8 million. That’s appealing, right?

Yet after taxes, closing costs, and broker fees, you walk away with around $1.35 million.

Now imagine this alternative:

- Sale price: $2.1 million

- Down payment: $600,000

- Financed amount: $1.5 million over 6 years

- Interest rate: 7%

- Total received over 6 years: $2.3 million+

Not only do you earn more over time, but your tax exposure can be reduced through income deferral depending on how the deal is structured.

According to research, businesses that include seller financing sell for 20% to 30% more than businesses that sell for all cash.

Plus, you’ve just created a monthly passive income stream that acts like your own private retirement annuity.

Who said retirement had to mean no income?

It’s not about selling cheaper. It’s about selling smarter and walking away with more.

How to Structure a Smart, Safe Seller Financing Deal

Here’s the good news: you don’t have to choose between risk and reward. With the right structure, you can have both.

Here’s what a solid seller-financed deal includes:

1. Substantial Down Payment

This proves the buyer is committed. 20–40% is typical. If they can’t afford that, they’re not serious.

2. Repayment Term

Most deals are 3–7 years, depending on your goals. Want faster payouts? Short-term. Want a steady income? Go longer.

3. Interest Rate

You’re taking on financing risk. You deserve to be compensated. 5–8% is common, much higher than most retirement accounts.

4. Security

This is critical. You secure the financing against the business itself—equipment, receivables, and patient contracts. If the buyer defaults, you have legal recourse.

5. Legal Protections

Promissory notes. Collateral agreements. Default clauses. Balloon payments. All of these should be professionally drafted. No shortcuts.

BONUS: Performance-Based Clauses

Some sellers tie repayments to revenue benchmarks, adding a layer of protection and upside. Seller financing doesn’t mean “hope they pay.” It means “structure it so they must.”

The Mistakes Doctors Make—And How to Avoid Them

Many doctors fall into the same traps when considering seller financing. Let’s walk through the top mistakes and bring them to life with short, hypothetical examples.

Trusting the Buyer Without Verification

Dr. Reynolds sells his ophthalmology clinic to a charming young buyer who “seems trustworthy.” No credit check. No background verification. Six months in, payments stop. Turns out, the buyer was deep in debt and running another failing practice on the side.

Always run background checks, demand financial statements, and verify employment and practice history. You’re not being difficult, you’re protecting your legacy.

No Security or Collateral in the Deal

Dr. Feldman finances 70% of her dermatology practice sale but forgets to secure the loan with the business’s assets. When the buyer defaults, there’s nothing to seize. Legal action is slow and expensive, and the practice is already gutted.

Always secure your loan. If they default, you should have the legal right to reclaim assets, re-sell, or restructure.

Structuring the Deal Without Tax Planning

Dr. Lopez takes 100% of the sale income in the first year, even though payments are spread out over five years. Result? A massive one-time tax bill that eats up 35% of her earnings.

Work with a tax strategist. Proper structuring can defer taxes, reduce capital gains exposure, and optimize your net income.

Going DIY Instead of Using Expert Advisors

Dr. Barrett decides to write up his financing terms using an online contract template. The buyer later exploits a vague clause to delay payments by six months with no penalty.

Dr. Barrett spends more fixing the issue than he saved by skipping legal fees.

Seller financing requires precision. Hire legal and financial experts who specialize in healthcare transactions.

Failing to Enforce or Monitor the Agreement

Dr. Lin sells his urgent care center and assumes the payments will “just arrive.” He doesn’t track the repayment schedule or monitor the buyer’s business. By the time he notices missed payments, the buyer is nearly bankrupt.

Enforce your agreement. Use a CPA or advisory firm to track payments and check compliance.

Each of these mistakes is 100% preventable. Only if you treat your sale with the same diligence you brought to your medical career.

You’d never perform surgery without a checklist. Why sell your practice without one?

Seller Financing Myths That Are Costing You Millions

Still hesitant? Let’s debunk a few myths:

- Only desperate sellers offer financing.

False. Savvy sellers use it as leverage to get higher price points and faster closes. - It’s too risky.

Not if you structure it properly—with security, protections, and advisors. - Buyers won’t respect me if I offer terms.

The best buyers prefer flexible, fair deals and are more likely to trust you. - I’ll just wait for an all-cash buyer.

You might wait for years, while your practice loses value every month you delay.

The reality? The biggest risk is doing nothing and waiting for the “perfect” deal that never comes.

The Consequences of Ignorance: What Happens If You Refuse to Adapt?

Let’s get straight to it.

Seller financing isn’t a trend. It’s a shift in the landscape. If you think you can ignore it and still walk away with a premium exit, you’re playing a dangerous game, one that countless doctors have already lost.

1. Diminishing Buyer Interest

Here’s the hard truth: buyers today are cautious, especially younger physicians and independent groups. They’re drowning in student debt, wary of interest rates, and struggling to secure traditional loans in time to compete.

When you refuse to offer flexible terms like seller financing, you immediately shrink your buyer pool by 50–70%. Think about that. You’re not just closing doors, you’re locking yourself out of your own exit.

“I’ll wait for a cash buyer.”

You may end up waiting forever. Every day you do, another buyer chooses a more adaptable seller.

2. Decreased Valuation Leverage

Refusing seller financing doesn’t just slow the sale—it drives your value down.

Let’s say your practice is worth $2.2 million. A buyer offers $2 million with 40% seller financing. You say, “No, cash only.”

Guess what happens next?

- The buyer walks.

- New prospects see that your practice has been sitting unsold.

- Offers start coming in at $1.6M, then $1.5M, maybe lower after some time.

The reason? Your leverage has evaporated. You’ve signaled rigidity. And in this market, rigid sellers lose.

Inflexibility isn’t power—it’s a liability. Especially when the market has moved on without you.

3. Time on Market Kills Deals

Every week your listing stays active, it gets stale. Brokers know it. Buyers know it. Competitors know it.

Dr. Lisa owned a successful pediatric practice in a growing suburb. She turned down three offers that included 30% seller financing, insisting on an all-cash deal.

After 18 months on the market, her practice was flagged as “unsellable” by multiple brokers.

The result? She sold for $500,000 less than her original asking price to a buyer who still asked for seller financing.

You can’t win a bidding war when there’s no one left to bid.

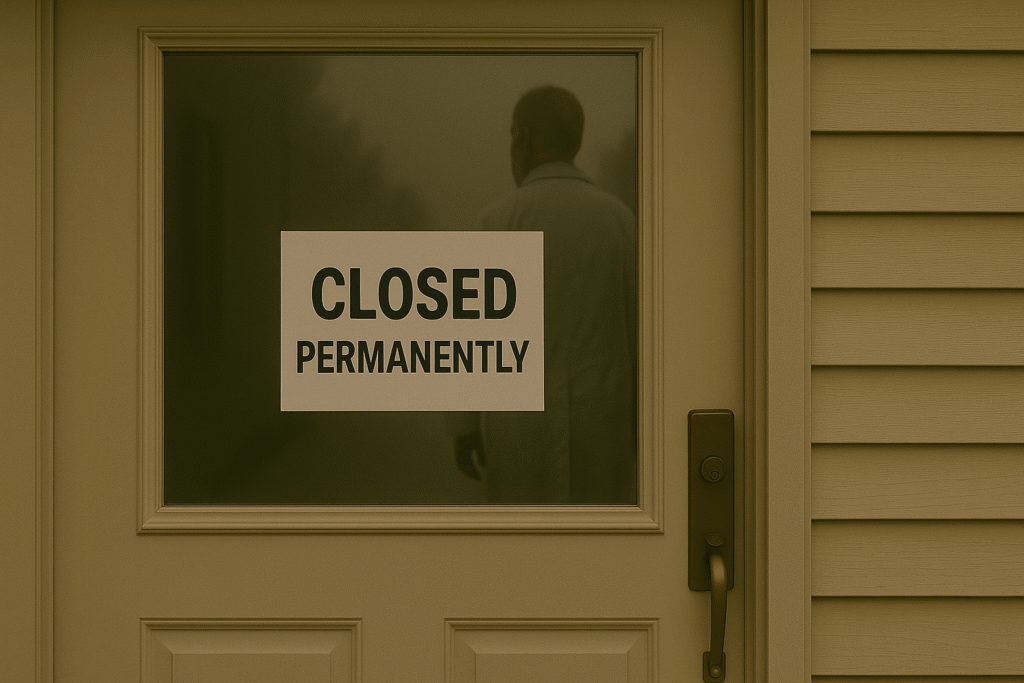

4. The Worst-Case Scenario: Forced Shutdown

You think it can’t happen to you?

Dr. Miller thought the same. He rejected multiple seller-financed offers over three years. Then COVID hit. Patient volume dropped. Revenue fell. His staff left. His retirement plans disappeared.

Eventually, he shut down the practice and liquidated the assets. All those decades of work—gone for pennies.

You spent your life building this practice—are you going to throw away millions over outdated thinking? You’ve been in control of patient outcomes for years. It’s time to take control of your exit with the same precision.

Adapt or watch everything you built slowly decay. The market rewards action-takers, not spectators clinging to the past.

The choice is yours. Do remember that the cost of inaction is higher than you think.

The Exit Is Inevitable. The Outcome Is Not.

There will come a day, sooner than you think, when your name comes off the door.

That moment is coming whether you plan for it or not. The only question is whether it will happen on your terms or by default.

Seller financing isn’t a tactic. It’s a signal.

A signal that you understand the stakes. That you know how today’s buyers think. That you’re not passively waiting for a miracle, you’re orchestrating your exit like the professional you’ve always been.

Let’s be clear, you didn’t spend decades building a practice by sacrificing weekends, shouldering responsibility, earning patient trust—just to panic sell it or watch it decay.

You built something that mattered.

Now it’s time to exit with the same precision, authority, and intelligence you brought to your medical career.

That’s where DiligenceSure comes in.

We’re not a brokerage. We’re not a checklist. We’re the elite team behind successful exits for doctors who refuse to be average. From due diligence to risk mitigation, from unbeatable deal terms to seller-financing strategy—we prepare your practice for maximum-value transition.

Quietly. Legally. Powerfully.

Here’s the truth no one else will tell you: you won’t get a second chance to sell your life’s work.

There is no “next time”; there is only this time. Right now.

You taught patients to take action before it was too late, now it’s your turn.

Call DiligenceSure, command your exit and leave on your terms.

Let the final chapter of your practice be the most powerful one yet.