12 Min Read

What’s the first thing a buyer will notice about your practice?

Your reputation? Your patient volume? Your impressive revenue stream?

No, the first thing they’ll notice is risk.

Picture this: A potential buyer steps into your office, clipboard in hand. They’re here to assess what their next profitable investment could be. They smile politely, but make no mistake — they’re not here to admire your décor or chat about your years of hard work.

They’re here to find problems.

As they scan the room, their eyes land on your desk — that’s when it happens. Stacks of patient files are piled high. Consent forms sit unsigned. An outdated Occupational Safety and Health Administration (OSHA) manual is tucked beneath a coffee-stained binder. To you, it’s just another busy day.

To the buyer? It’s a giant red flag.

“If their paperwork looks like this,” the buyer thinks, “what else have they neglected?”

In that instant, your practice’s value takes a hit — and you may never even realize it.

Sounds extreme? It’s not.

Buyers aren’t just looking for potential — they’re looking for excuses to lower their offer or walk away entirely. They’ll dig through your records with one goal in mind: finding vulnerabilities that give them leverage.

An expired license? They’ll assume you’ve overlooked other critical details.

Incomplete staff contracts? They’ll imagine legal headaches down the road.

Billing inconsistencies? They’ll picture costly audits — and demand a lower price to compensate.

Here’s the truth: Even if your practice is thriving, compliance gaps will scare buyers away. They’ll question your reliability, doubt your systems, and lose trust in your numbers.

And once that trust is broken? Good luck getting it back.

So ask yourself: If a buyer walked through your doors today, would they see a practice that’s sale-ready or a deal filled with risk?

If you’re not certain, keep reading — because fixing these issues after a buyer finds them is often too late. The regulatory compliance checklist you’re about to see in this blog post could mean the difference between maximizing your sales or watching buyers disappear without warning.

According to the National Library of Medicine, Administrative work consumes one-sixth of U.S. physicians’ working hours and lowers their career satisfaction.

The Buyer’s Mindset

Most doctors believe buyers are walking into their practice hoping to see potential. That’s a dangerous misconception.

Buyers aren’t optimists — they’re skeptics. And they have good reason to be.

Imagine this from the buyer’s perspective: They’re about to invest hundreds of thousands — maybe even millions — into your practice. If something goes wrong after the deal closes, they inherit the mess. Unpaid taxes? Their problem. Compliance gaps? Their headache. Staff disputes? Their legal bill.

That’s why buyers don’t step into your office thinking, “This place looks great!” They’re thinking, “Where’s the problem?”

And they won’t stop until they find one.

Buyers operate with a “Risk Radar” — a heightened instinct for anything that smells ‘off.’ The tiniest red flag — a missing OSHA log, an unsigned contract, or inconsistent billing records — sets off alarm bells.

Even a minor issue can convince them there’s a deeper problem lurking beneath the surface.

Worse yet, once doubt creeps in, it snowballs.

Consider this: One doctor had a thriving practice with impressive financials. However, during the buyer’s inspection, they noticed expired provider licenses. That discovery led to questions about staff training records, OSHA protocols, and even patient documentation. The more they dug, the more suspicious they became — until they walked away entirely.

The truth is harsh: Buyers won’t give you the benefit of the doubt. They’ll assume the worst because they can’t afford not to.

So here’s the question you need to answer: If a buyer started digging through your practice today, would they feel confident or concerned?

The Non-Negotiable Regulatory Compliance Checklist – What Buyers Will Demand

Selling your practice isn’t just about showing buyers your success — it’s about proving you haven’t overlooked risks.

Buyers won’t just ask about your compliance — they’ll inspect it. And if they find even one mistake, they’ll assume there are more lurking beneath the surface.

According to the American Hospital Association, healthcare organizations spend about $39 billion annually on administrative tasks for regulatory compliance.

Here’s what buyers will demand — and what’s at stake if you fail to meet those demands.

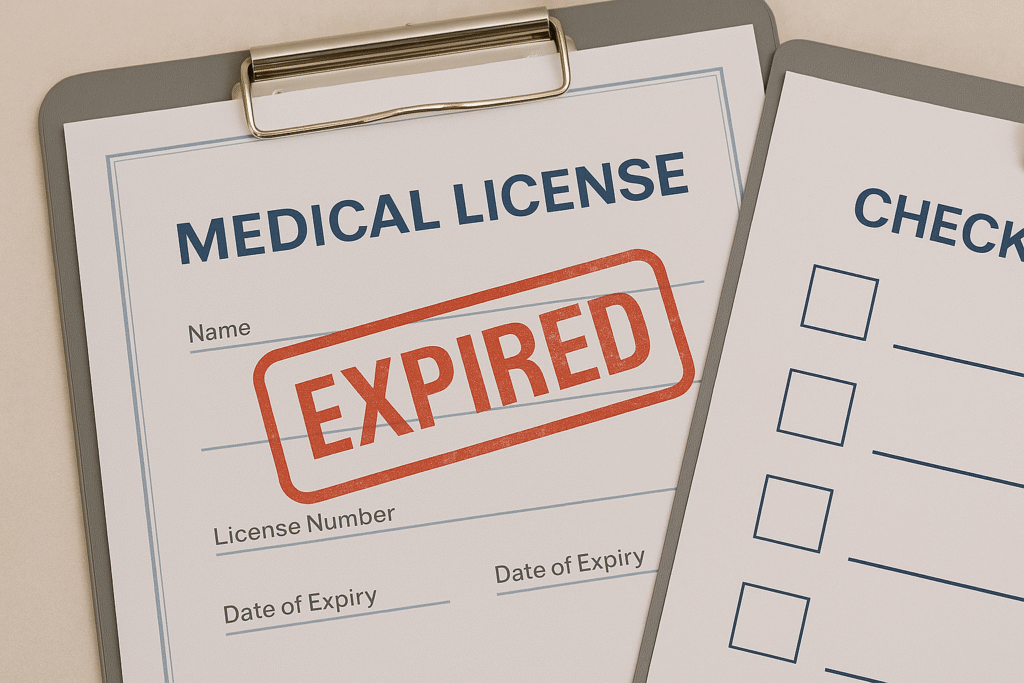

1. Licensing and Credentialing – The Silent Deal Killer

A successful pediatrician was on track to sell his thriving practice. He had strong financials, loyal patients, and a reputation for excellence. But during the buyer’s inspection, one overlooked detail unraveled everything — an expired provider license.

It wasn’t even his — it was a part-time physician who hadn’t practiced there in over a year. The doctor assumed it wasn’t a big deal. After all, the provider was no longer on staff.

The buyer didn’t see it that way.

To them, that one expired license screamed disorganization. If the doctor had missed this, what else had he overlooked? Were other records outdated? Were there unresolved billing issues? Was the entire practice riddled with risks they hadn’t yet uncovered?

The deal was put on hold. The doctor scrambled to provide updated records, but the damage was done. The buyer lost confidence — and ultimately walked away.

Action Step: Don’t assume “inactive” or part-time providers don’t matter. Audit every provider’s license now — confirm dates, statuses, and renewal deadlines.

2. HIPAA Compliance – The Lawsuit Magnet

Think HIPAA violations won’t concern buyers? Think again.

A dermatologist with a thriving practice had never faced a HIPAA complaint in over 20 years. However, during due diligence, the buyer discovered her staff hadn’t completed HIPAA training in over five years. Even worse, her outdated privacy policy failed to meet current standards.

According to the HIPAA Journal, in 2023, a record-breaking 168 million healthcare records were exposed, stolen, or impermissibly disclosed, with 2022 seeing 51.9 million and 2021 45.9 million. Human error and negligence, rather than external hacking, are the primary causes of most HIPAA breaches, affecting over 176 million patients.

The buyer immediately calculated the risk:

- If a patient filed a complaint, the new owner could face fines or legal action.

- If regulators launched an audit, the practice could be hit with costly penalties.

The buyer didn’t want to inherit that liability, so they demanded a reduced price to offset the risk. The dermatologist had no choice but to slash her asking price by $150,000 to keep the deal alive.

Action Step: Conduct a HIPAA self-audit. Ensure staff training records are updated, privacy policies are current, and security measures are in place.

3. Employment Agreements and Contracts – The Hidden Legal Trap

An orthopedic surgeon had built a thriving practice with loyal staff. Confident that his team would stick around post-sale, he didn’t think twice about his employee contracts.

Big mistake.

When the buyer reviewed the contracts, they found gaping holes — some agreements were unsigned, others had no clear non-compete terms, and key staff had no binding Non-Disclosure Agreements.

The buyer knew what this meant:

- Key employees could resign without warning.

- Staff could take patient lists, or even open a competing practice down the street.

- The buyer could face lawsuits, turnover issues, or patient loss after closing.

Seeing the risk, the buyer walked away, and the doctor spent months scrambling to rewrite contracts before finding another buyer.

Action Step: Review every employee contract — ensure they are properly signed, dated, and include clear non-compete terms.

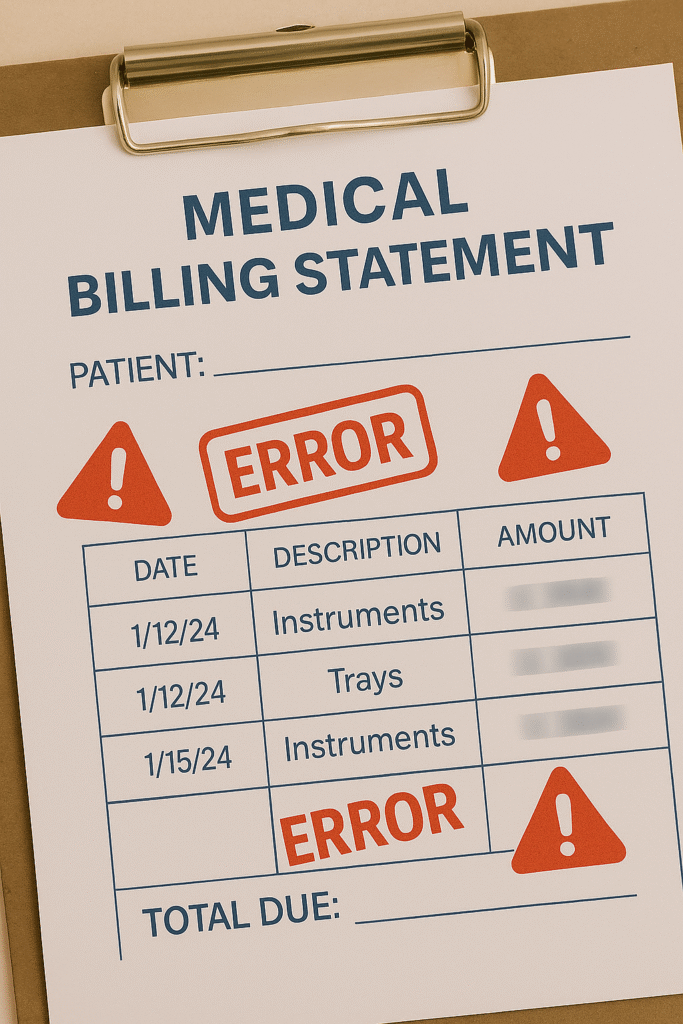

4. Billing and Coding Compliance – The Audit Nightmare

A gastroenterologist selling his practice felt confident that his billing records were in order. After all, his revenue was strong, and he hadn’t faced insurance disputes in years.

But when buyers inspected his records, they found multiple instances of incorrect billing codes — nothing malicious, just honest mistakes.

Unfortunately, that didn’t matter.

The buyer realized these errors could trigger an insurance audit after they acquired the practice. Worse, if regulators found discrepancies, the new owner could face costly penalties — even though they weren’t responsible for the mistakes.

The buyer demanded a significant reduction in the purchase price to account for the risk.

Action Step: Conduct a billing audit now. Ensure all codes are accurate, records are complete, and no patterns of errors exist.

5. OSHA and Infection Control Standards – The Deal Breaker Buyers Won’t Ignore

A dentist eager to retire assumed his clean, well-organized practice would impress buyers. However, during the inspection, buyers found outdated sterilization logs and expired OSHA training certificates.

To the dentist, these were minor oversights. To the buyer, they were potential lawsuits waiting to happen.

What if a patient filed a complaint? What if regulators launched an unannounced inspection? The buyer knew they’d be the one facing fines, penalties, or worse — liability for patient harm.

The deal was put on hold. The dentist had to invest thousands in updated protocols, staff training, and documentation before the buyer would even reconsider.

According to research, in 2020, the healthcare and social assistance industry reported a 40% increase in injury and illness cases, which continues to be higher than any other private industry sector.

Action Step: Review OSHA protocols now — ensure sterilization records, safety procedures, and staff training logs are updated and accessible.

6. Documentation and Record-Keeping – The First Thing Buyers Will Judge

Buyers love organized records, and they’ll assume disorganization means deeper problems.

An Ear, Nose, and Throat (ENT) specialist had strong financials, but his record-keeping was a mess. Patient files were scattered across multiple systems, employee records were incomplete, and key financial documents were missing.

The buyer wasn’t willing to gamble. Disorganized records made them question the accuracy of the ENT’s financial reports, and they ultimately backed out of the deal.

The doctor spent the next six months sorting records, hiring consultants, and updating systems before finally securing a sale.

Action Step: Centralize your records now. Ensure financials, employee files, and operational paperwork are clear, complete, and accessible.

Buyers Will Find What You’ve Overlooked

Think you can fix these problems after a buyer shows interest? Don’t count on it.

By the time they uncover issues, their trust is already damaged. Even if you scramble to fix mistakes, buyers will wonder: What else have they missed?

And that doubt can cost you thousands, or even kill the deal entirely.

So ask yourself:

- Are your licenses, certifications, and training records up to date?

- Are your employee contracts rock-solid and properly signed?

- Could your billing records survive an insurance audit?

- Are your OSHA protocols organized and current?

- Is your documentation clear, complete, and accessible?

If you can’t answer “yes” to every question, you’re not ready to sell.

Don’t assume buyers will give you the benefit of the doubt — they won’t.

Instead, take control now.

Tick these off from the regulatory compliance checklist before buyers uncover the risks, because once they do, your leverage disappears.

The “Silent Traps” That Blindside Sellers – And How to Spot Them

You’ve fixed the big issues — licenses are updated, contracts are solid, and your records are organized. You’re ready to sell, or so you think.

But what about the silent traps — the overlooked risks quietly waiting to sabotage your deal?

Insurance coverage gaps. Expired Drug Enforcement Administration (DEA) licenses. Outdated consent forms buried in your filing cabinet. These might seem minor, but to a buyer, they scream liability.

Buyers will dig deeper than you expect — and they won’t stop at surface-level issues. They’ll search for:

- Unresolved patient complaints — A single dispute could signal ongoing legal trouble.

- Unpaid taxes — Buyers won’t inherit your debt, but they will question your financial stability.

- Vendor agreements — One doctor overlooked a five-year equipment lease that forced the buyer to pay thousands for outdated devices. The deal nearly collapsed, and the seller ended up paying out of pocket just to salvage the sale.

Have you overlooked the silent traps? Because if you don’t find them first, your buyer will.

They’re Digging, And They’ll Find It

Right now, there’s someone out there — a competitor, an investor, or a corporate buyer — scanning practices just like yours. They’re looking for opportunities, but more importantly, they’re looking for vulnerabilities.

And here’s the uncomfortable truth: If your compliance gaps aren’t fixed, they’ve already beaten you.

Imagine this — a buyer expresses interest in your practice. They quietly reach out to a colleague, a former employee, or even a patient to ask questions. They hear about disorganized records, inconsistent billing, or outdated policies. Do you think they’ll give you a fair chance to explain?

They won’t.

They’ll quietly cross your practice off their list — and move on to your competitor down the street. No warning, no second chances. Just an opportunity lost without you even realizing it.

DiligenceSure exists so that doesn’t happen to you. It’s not just a checklist — it’s your insurance policy against buyer doubt. With DiligenceSure, you’ll know exactly what buyers are hunting for — and you’ll fix those gaps before they’re used against you.

The most valuable practices aren’t just profitable — they’re prepared.

If you’re not sure your practice could survive buyer scrutiny, there’s no time to waste. Protect your practice. Protect your legacy.

Start now — before someone else decides your practice isn’t worth the risk.