11 Min Read

Are you truly prepared to sell your practice? Or do you just assume you are?

Here’s the reality—most doctors walk into the sales process blind. They think their years of hard work automatically translate into a high-value deal. They assume buyers will see their dedication and reward them with a fair price. But assumptions don’t close deals—flawless financials do.

And if yours aren’t airtight? You’re not just at risk of losing a little. You could lose everything.

Buyers don’t “guess” at value—they scrutinize, dissect, and rip apart financial records, searching for weaknesses they can exploit. A single inconsistency, a bloated expense report, or an unstable revenue stream can send them running—or worse, give them leverage to slash their offer in half.

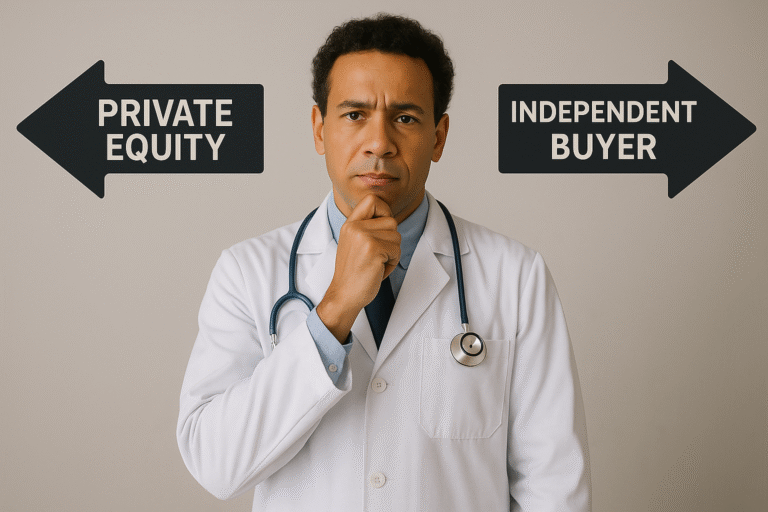

According to the Medical Group Management Association, in the past 10 years, more than 500 hospitals have merged into a larger health system. More than $100 billion has been spent on hospital consolidation in the last six years alone. The top three publicly traded payers have a combined enterprise value of more than $350 billion, providing scale, significant negotiating leverage, and almost unlimited access to capital.

As a result, more and more medical professionals have sold or are considering selling/merging their practices or pursuing similar partnerships.

How much money are you unknowingly leaving on the table? $50,000? $250,000? More? The worst part? You won’t even know until it’s too late.

The good news is you still have time to take control. If you commit to this 12-month financial checklist now, you can command top dollar and avoid negotiations, and that will be your first step to committing to prepare financials for a seamless sale.

The smart doctors will act immediately. The rest? They’ll realize their mistakes when they’re staring at a disappointing offer—or no offer at all.

You have 12 months. The clock is ticking. Let’s get to work.

Your 12-Month Financial Checklist to Prepare Financials for a Seamless Sale

The strongest offers don’t go to the best doctors. They go to the best-prepared sellers. If your financials are messy, bloated with unnecessary expenses, or riddled with inconsistencies, buyers will use them against you.

This 12-month checklist is your roadmap to maximizing your valuation, eliminating deal-killing red flags, and ensuring a seamless sale. Time is limited—every month counts. Follow this process, and you’ll be in control. Ignore it? You’ll be at the mercy of buyers looking for a discount.

Month 1-3: Expose the Cracks Before Buyers Exploit Them

Selling your practice isn’t just about finding a buyer—it’s about surviving their scrutiny. Buyers will tear through your financials, searching for weaknesses to lower their offer or walk away.

Most doctors make one fatal mistake: waiting until negotiations to find out what’s wrong. By then, buyers have all the leverage, and you’re stuck justifying messy books, bloated expenses, or unstable revenue. That’s how deals collapse—or how you get manipulated into accepting far less than you deserve.

Your first step? Think like a buyer and identify weaknesses—before they do. The next three months are about auditing, cutting waste, and stabilizing revenue to eliminate red flags that could tank your sale.

Audit Everything—Would You Buy Your Practice?

If you were a buyer, would you see a profitable, well-run business—or a financial mess? Buyers will scrutinize every number. Fix issues now.

Focus on:

- Profit & Loss Statements and Tax Returns (Last 3 Years): Are they clean and consistent?

- Outstanding Liabilities: Debts, lawsuits, or lease obligations? Red flags.

- Accounts Receivable: Slow collections signal unstable cash flow.

- Hidden Inefficiencies: Unused equipment? Excessive payroll?

If you find one issue, a buyer will find ten.

Cut the Fat: Eliminate Expenses That Drag Down Value

Buyers don’t just look at revenue—they analyze profitability. Bloated expenses mean inefficiency, and inefficiency means lower offers.

Ask yourself:

- Are personal expenses mixed in?

- Is payroll bloated?

- Are you overpaying for services?

Trim the fat now—before buyers use it against you.

Normalize Revenue—Buyers Want Stability, Not Chaos

Unpredictable income -> risk -> lower offers. Buyers want steady, reliable revenue.

- Address seasonal dips—adjust marketing and scheduling.

- Renegotiate contracts for consistent cash flow.

- Improve billing & collections.

- Diversify income sources.

Buyers pay top dollar for predictable income. If yours isn’t stable, fix it now.

Messy books, high expenses, and volatile revenue kill deals. The best sellers eliminate red flags before buyers see them.

You’ve got nine months left. Are you getting ahead of the problems—or waiting to lose money?

Month 4-6: Build a Bulletproof Financial Story

Numbers don’t lie—but messy, unclear, or misleading financials will kill your deal.

Buyers aren’t just looking at revenue; they want a clear, stable, and profitable business. If your financial story has holes, expect skepticism, delays, and lower offers.

In the next three months, your job is to clean up, strengthen, and prove your financial worth. If you don’t, buyers will assume the worst—and price your practice accordingly.

4. Clean Up the Books—Because Buyers WILL Investigate

Sloppy financials raise red flags. If your numbers don’t add up, buyers will either dig deeper—or walk away.

Fix it now:

- Work with a healthcare-specific accountant to ensure accuracy.

- Separate personal and business expenses—buyers don’t want to sift through your spending.

- Ensure every dollar is documented, categorized, and accounted for. Missing details equals missing trust.

A clean, organized financial report builds buyer confidence and speeds up negotiations.

5. Strengthen Your Balance Sheet: Debt & Liabilities Matter

If your financials show instability, buyers will assume your practice is a risk. And risk leads to lower offers or no offers at all.

Here’s what to fix:

- Reduce unnecessary debt—a high debt load makes buyers nervous.

- Clean up accounts receivable—outstanding payments make cash flow unpredictable.

- Settle pending liabilities—lawsuits, lease obligations, or financial disputes are deal killers.

The stronger your balance sheet, the more valuable your practice appears.

6. Prove Profitability—What Smart Buyers Are Looking For

Your practice isn’t worth what you think—it’s worth what you can prove.

Buyers analyze key financial metrics to determine if your practice is a goldmine or a risky business deal.

- Show consistent profitability with clear revenue trends.

- Adjust EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to highlight true earnings.

- Provide transparent expense reporting—hidden costs = hidden risks.

Strong, verifiable profitability = strong offers. Anything less? Expect hesitation and low bids.

At this stage, buyers should see a clean, profitable, and well-structured financial story. If they see confusion, debt, or missing details, expect delays, skepticism, and price cuts.

You’ve got six months left. Will you be a seller buyers trust—or one they avoid?

Month 7-9: Increase Your Practice’s Perceived and Actual Value

By now, your financials should be clean and structured—but that’s not enough. Buyers don’t just look at numbers; they assess stability, profitability, and growth potential. They see whether your revenue is inconsistent or you’re bleeding money due to poor billing practices.

Your goal for these three months? Maximize revenue, lock in predictability, and make your practice look like a high-value investment.

7. Optimize Cash Flow: Buyers Pay for Predictability

Unstable cash flow = unstable valuation. Buyers want to see steady, predictable income. If your collections process is sluggish or inconsistent, you’re giving buyers a reason to doubt your financial stability.

Fix it now:

- Shorten billing cycles—speed up claim submissions and collections.

- Automate collections—reduce delays and patient payment gaps.

- Review patient payment structures—offer prepayments or incentives for early payment.

Predictable cash flow means a higher valuation. If yours is erratic, expect buyers to hesitate—or reduce their offer.

8. Maximize Reimbursements and Reduce Revenue Leakage

Most practices lose 10-20% of revenue due to poor billing and reimbursement structures. That’s money you should be pocketing—but instead, it’s leaking away. Buyers will notice.

What to fix:

- Optimize coding—ensure correct codes for maximum reimbursements.

- Renegotiate payer contracts—higher rates = higher profits.

- Streamline billing—eliminate errors, reduce denials, and improve collections.

Every dollar you recover is a dollar added to your valuation. Don’t let inefficiencies drain your sale price.

9. Strengthen Recurring Revenue Streams

A practice with stable, recurring revenue is far more attractive to buyers. If your income relies solely on one-time visits, you’re missing out on higher offers and stronger negotiations.

How to add recurring revenue:

- Introduce membership programs or subscription-based wellness plans.

- Lock in long-term contracts with patients or corporate partnerships.

- Expand ancillary services—sell supplements, offer concierge medicine, or add elective procedures.

Buyers pay more for predictable, long-term income. If you don’t have recurring revenue, you’re leaving money on the table—right now.

According to Health Affairs, a broader mix of revenue streams is closely linked to higher per capita earnings.

At this stage, your practice should be running lean, profitable, and predictable. If you fix cash flow, recover lost revenue, and strengthen recurring income, you’ll command stronger offers. If you don’t? Buyers will see risk—and lower their bids.

You have three months left. Are you maximizing value—or settling for less?

Month 10-12: Finalizing & Positioning for Maximum Offers

You’re in the final stretch. Every number should be in order and every inefficiency eliminated. Sounds good? Don’t get comfortable yet—this is where deals are won or lost. The last three months are about positioning your practice as a high-value investment and assembling the right team.

10. Prepare Projections: Sell the Future, Not Just the Past

Buyers aren’t just paying for what your practice is worth today—they’re investing in what it will be worth tomorrow. If you don’t present a compelling future, you’ll get offers based on historical numbers alone.

- Create solid financial projections that show realistic growth.

- Highlight scalability—can new owners expand services, add providers, or increase efficiency?

- Show untapped opportunities—unused treatment rooms, underutilized staff, new patient demographics.

Buyers love a practice with room to grow. Give them a clear narrative, and they’ll pay a premium.

11. Assemble a Rockstar Financial & Legal Team

One bad contract, one tax mistake, or one overlooked clause could cost you millions. Don’t assume you can do this alone.

- Hire a healthcare-specific professional—ensure accurate valuations and tax-efficient structuring.

- Get a top-tier Merger & Acquisition (M&A) attorney—protect yourself from hidden liabilities.

- Work with an M&A advisor—position your practice for the best possible deal.

The best professionals don’t take just any client—if you wait too long, you may end up with second-rate advisors who could cost you more than they save.

12. Have an Exit Tax Strategy—Or Lose a Huge Chunk of Your Sale

Imagine working decades to build your practice—only to lose 30-50% of your selling price to taxes. That’s exactly what happens to sellers who don’t plan.

- Optimize capital gains strategies—structure your sale for tax efficiency.

- Consider deferred compensation or retirement planning—reduce your tax burden.

- Work with a tax strategist early—because waiting until closing means you’ve already lost.

The doctors who fail at this stage walk away with far less than they deserve. The smart ones? They plan, position, and profit. Which one will you be?

Your Practice. Your Profit. Your Future.

You didn’t build your practice overnight. It took years of dedication, long hours, and relentless commitment to get to where you are. As you prepare to sell, ask yourself: Will you walk away with the deal you deserve, or will you leave money on the table?

The difference between a six-figure and a seven-figure exit isn’t luck. It’s preparation. It’s strategy. It’s making sure buyers see the full value of what you’ve built—not just the flaws they can exploit.

Yet, most doctors make the same mistake. They assume they can figure it out along the way. They assume buyers will play fair. They assume they don’t need expert help—until it’s too late.

This is where DiligenceSure changes everything. We know that selling a practice isn’t just a transaction—it’s a financial and emotional milestone that deserves precision, strategy, and expertise.

- We help you get your financials in order—before buyers even ask the tough questions.

- We ensure your practice is positioned for maximum valuation—so you get the highest offers possible.

This is your moment. You can either sell smart and secure the deal of a lifetime—or risk selling blind and regretting it forever.

The doctors who succeed don’t wait. They take action.

So, are you going to sit back and hope for the best? Or are you going to prepare, position, and profit?

The choice is yours. Time is running out.

Let’s make sure you win.