12 Min Read

Do you think your practice is ready to sell? Don’t be so sure.

You’ve worked hard to build your practice. Years of dedication, patient care, and countless sleepless nights have brought you to this point — the opportunity to cash in on everything you’ve built. Yet, there’s a hidden threat that could wipe out thousands — or even millions — from your sale price?

HIPAA violations — even minor ones — can destroy your deal faster than you think.

It doesn’t matter how successful your practice is. It doesn’t matter if your revenue is strong or your patient base is thriving. If a buyer uncovers HIPAA compliance gaps during due diligence, everything can unravel instantly.

Are you certain your compliance records are flawless?

Buyers will scrutinize every detail — and they’ll exploit every gap they find.

Here’s the truth: buyers are trained to look for weaknesses. They know that exposing a potential liability — like incomplete HIPAA documentation, outdated privacy policies, or weak data security — gives them power. The moment they find a compliance issue, the conversation shifts.

Suddenly, you’re not in control of the deal anymore — they are.

“This could be a major risk,” they’ll say.

“We’re going to need to adjust the offer.”

And just like that, the value of your practice shrinks before your eyes.

It doesn’t stop there. In some cases, buyers may walk away entirely, spooked by the mere possibility of a data breach or regulatory fine. Even if no breach has occurred, the fear of future liability is enough to send them running.

Buyers aren’t just looking at your financials — they’re searching for risks.

HIPAA gaps signal one thing to a buyer: liability. And liability means leverage — leverage they can and will use to drive down your sale price or manipulate the terms of your deal.

The question is: will you let that happen?

If you’re serious about selling your practice for its true value, you can’t afford to overlook this threat. The doctors who assume they’re compliant — without proof — are the ones who pay the steepest price when it’s too late to fix it.

This blog post enables you to steer clear of misconceptions when it comes to how HIPAA compliance can affect your practice sale, allowing you to bolster your data privacy guardrails.

What Is HIPAA Compliance — and Why It’s Your Silent Weakness

HIPAA compliance isn’t just another set of rules — it’s a potential minefield that could sabotage your practice sale if you’re not careful.

At its core, HIPAA compliance is about protecting patient information. It’s a system of safeguards designed to ensure that sensitive data — like medical records, treatment history, and billing details — stays secure, private, and properly managed.

But here’s what most doctors don’t realize: HIPAA compliance isn’t just about keeping files locked away or using a secure EHR system. It’s far more complex — and far easier to overlook.

According to the HIPAA Journal, between 2009 and 2023, 5,887 healthcare data breaches of 500 or more records were reported to OCR. Those breaches have resulted in the exposure or impermissible disclosure of 519,935,970 healthcare records. That equates to more than 1.5x the population of the United States.

To meet HIPAA standards, your practice must have strict protocols in place for:

- Patient record security — both digital and physical.

- Staff training — ensuring employees know how to handle sensitive data.

- Documented breach response policies — proof that you’re prepared if a data leak occurs.

- Proper record disposal — ensuring old files are destroyed securely, and not left vulnerable.

Assuming your EHR system “handles HIPAA” is a dangerous mistake. Buyers will demand clear evidence that your entire practice — from front desk staff to data storage — is HIPAA-compliant. Without it, your sale is at serious risk.

How Doctors Unknowingly Violate HIPAA — And Ruin Their Sale

You may think you’re compliant — but are you certain?

Far too many doctors believe their practice is HIPAA-compliant simply because they haven’t faced an investigation or received a complaint. The reality is that HIPAA violations often go unnoticed — until the moment you decide to sell.

That’s when buyers dig deep. They’ll uncover compliance gaps you didn’t even know existed — and they’ll use those gaps to slash your sale price or walk away entirely.

Here’s the frightening part: these violations often hide in plain sight. Even experienced doctors make these costly mistakes — and they don’t realize it until it’s too late.

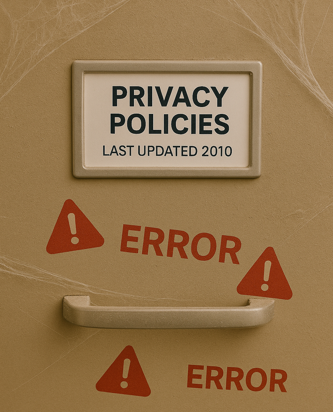

1. Outdated Privacy Policies Sitting in a Drawer

Dr. Morgan, a successful pediatrician with 15 years in practice, assumed her compliance was rock solid. After all, her privacy policy was drafted by a lawyer when she opened her practice. However, during due diligence, a potential buyer requested documentation of her most recent privacy policy update.

That’s when Dr. Morgan realized the truth — her policy hadn’t been updated in over a decade. HIPAA guidelines have changed multiple times since then, meaning her outdated policies no longer meet current standards.

The buyer’s response? They demanded a $70,000 discount to account for the cost of updating her compliance protocols — or they were prepared to walk away.

2. Employees Accessing Patient Data on Unsecured Devices

Dr. Smith, a busy cardiologist, trusted his staff to follow proper data security procedures. What he didn’t know was that one of his nurses regularly accessed patient records from her personal laptop at home — a laptop with no encryption, no security updates, and no firewall protection.

No data breach ever occurred, but that didn’t matter to the buyer. The moment they discovered this, they flagged it as a “high-risk liability.” The buyer’s attorney pushed for a price reduction of $100,000 to mitigate future risk — and Dr. Smith had no choice but to accept.

According to HIPAA Journal, in 2023, 725 data breaches were reported to OCR and across those breaches, more than 133 million records were exposed or impermissibly disclosed.

3. Failure to Log and Document Breach Incidents

Dr. Andrews, a family physician, experienced a small mishap — a staff member accidentally emailed a patient’s prescription details to the wrong person. They immediately informed the patient, apologized, and thought the issue was resolved.

But here’s the problem: there was no documented report of the incident.

When a potential buyer reviewed Dr. Andrews’ compliance records, they found no breach log at all — a major red flag. Even minor incidents must be logged as part of HIPAA’s breach response requirements. The buyer viewed this as evidence of sloppy compliance management and insisted on a substantial reduction in the sale price to account for potential fines.

4. Weak Data Encryption and Poor Password Controls

Dr. Kim, an orthopedic surgeon, had invested heavily in an expensive EHR system, assuming that covered her HIPAA obligations. What she didn’t know was that her staff had been sharing a single password for months to make logins “easier.”

During the buyer’s inspection, this oversight was flagged as a significant data security risk. The buyer’s attorney calculated the cost of upgrading security systems and enforcing stricter protocols — and Dr. Kim ended up losing $50,000 off her sale price as a result.

The Risk You Can’t Afford to Ignore

The scariest part? These doctors weren’t careless — they were simply unaware.

Even a well-meaning employee’s slip-up — like emailing records to the wrong address or leaving a patient chart visible on a desk — can turn your practice into a liability nightmare.

And if those gaps aren’t documented, corrected, and properly recorded, buyers will find them — and they’ll make you pay for it.

When Was the Last Time You Conducted a Full HIPAA Audit?

Ask yourself this:

- Have you reviewed your privacy policies in the last 12 months?

- Can you provide documentation proving your staff is properly trained?

- Could you confidently hand over detailed breach records to a buyer — if they demanded them today?

If you can’t answer yes to every question, your sale is already at risk. Buyers will find your HIPAA gaps — and they’ll use them against you.

The good news? There’s still time to fix it — but only if you act now.

The Consequences: How HIPAA Gaps Can Destroy Your Practice’s Value

A single HIPAA mistake can cost you everything.

If you think a small compliance gap is no big deal, you’re dangerously mistaken.

HIPAA violations don’t just invite fines — they can cripple your sale, drain your practice’s value, and leave you with nothing to show for years of hard work.

Here’s what’s at stake:

Severe Financial Fallout

HIPAA fines are brutal — up to $50,000 per violation. But that’s just the beginning.

When buyers uncover compliance gaps, they’ll demand costly concessions. Imagine being forced to knock $200,000 off your asking price — not because your practice isn’t profitable, but because your privacy policies are outdated, or your staff skipped data security training.

Even worse? Buyers can walk away entirely if they believe your HIPAA issues are too risky to fix.

According to the National Institute of Health, for a HIPAA violation due to willful neglect that is not corrected, the penalty is $50,000 per violation, with an annual maximum of $1,000,000, $50,000, or $1.5 million per violation.

Buyer Manipulation Tactics

Buyers know exactly how to use compliance flaws to their advantage. The moment they find a weak spot, they’ll:

- Delay negotiations — pushing you into a corner.

- Demand steep discounts — claiming they need to “offset future risks.”

- Threaten to back out — forcing you to accept their terms or lose the deal.

The Six-Figure Mistake

Dr. Harris, a successful dentist, discovered this the hard way. During due diligence, a buyer found that his staff had never received formal HIPAA training. No breaches had occurred, but the buyer claimed this “exposed the practice to future risk.”

Result? A $125,000 price cut.

Don’t assume your compliance gaps will go unnoticed — buyers are trained to find them. And when they do, they’ll make sure you pay the price.

Close the Gaps, Close the Deal

Think your practice is safe? Are you willing to bet your entire sale on it?

That’s exactly what’s at risk — your sale price, your reputation, and everything you’ve worked for. HIPAA gaps don’t announce themselves — they sit quietly in your practice, waiting for a buyer to find them. And when they do, you won’t just lose a few thousand dollars — you could watch six figures vanish in seconds.

Buyers are trained to hunt for weaknesses. They’ll dissect your compliance records, interview your staff, and dig into every corner of your practice until they find something to exploit.

And they will find something — unless you get there first.

So ask yourself this: Are you absolutely certain your practice could survive that kind of scrutiny?

Most doctors assume they’re safe — until they’re blindsided by a buyer who knows more about their practice than they do.

That’s when the panic sets in:

“Wait… when was the last time we updated our privacy policy?”

“Do we even have documented proof of staff training?”

“Did anyone ever record that breach incident last year?”

By the time you’re scrambling for answers, it’s already too late. The buyer has the upper hand — and your practice’s value is sinking fast.

Here’s the good news: It doesn’t have to happen that way.

With DiligenceSure, you can expose those silent threats before a buyer does. This powerful platform is designed to help doctors like you uncover compliance gaps, organize documentation, and prove your practice is secure.

Think of it as your personal HIPAA insurance — a safeguard that eliminates risks before they become deal-breakers.

Here’s what DiligenceSure does for you:

- Identifies overlooked compliance gaps hiding in your practice.

- Organizes your policies, training records, and breach logs in one place.

- Provides clear documentation so you can prove — not just claim — your practice is compliant.

Imagine the power you’ll have walking into negotiations fully prepared. While other doctors panic as buyers tear apart their records, you’ll hand over an airtight compliance report with confidence.

No excuses. No leverage. No room for manipulation.

What do buyers hate most? A seller who’s one step ahead.

They can’t demand discounts if you’ve already fixed the flaws.

They can’t delay negotiations if you’ve eliminated every risk.

And they can’t dominate you into lowering your price when you’ve proven your practice is worth every dollar.

So here’s the real question: Are you prepared to defend your practice — or are you hoping no one asks the hard questions?

Don’t gamble with your future. Don’t assume buyers won’t find what you’ve missed. When it comes to selling your practice, guessing isn’t a strategy — it’s a costly mistake.

Take control now. Get ahead of the risks. And when the day comes to sell, walk into that room with confidence — knowing you’ve left buyers nothing to use against you.

DiligenceSure gives you that power — but only if you act before someone else exposes the gaps first.

The choice is yours. Will you protect your practice — or leave it vulnerable to attack?