11 Min Read

If you had to put a price on your practice right now, what would it be? Take a moment and think about it. A number probably came to mind—one based on years of dedication, patient loyalty, and the reputation you’ve built. But here’s a question: Would a buyer see the same number?

Most doctors assume their practice is worth a straightforward multiple of revenue—perhaps 1x or 2x annual revenue—but in reality, that’s not how buyers think. The healthcare acquisition market is becoming more sophisticated, and if you aren’t clear on how buyers value practices, you could leave hundreds of thousands (or even millions) on the table.

Buyers don’t just look at revenue. They look at something far more important—profitability. The strength of your practice isn’t measured by how much money comes in. It’s measured by how much is left over after expenses. And that’s exactly why Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is the primary metric buyers rely on.

According to Medical Economics, profitability plays a crucial role in determining a practice’s value.

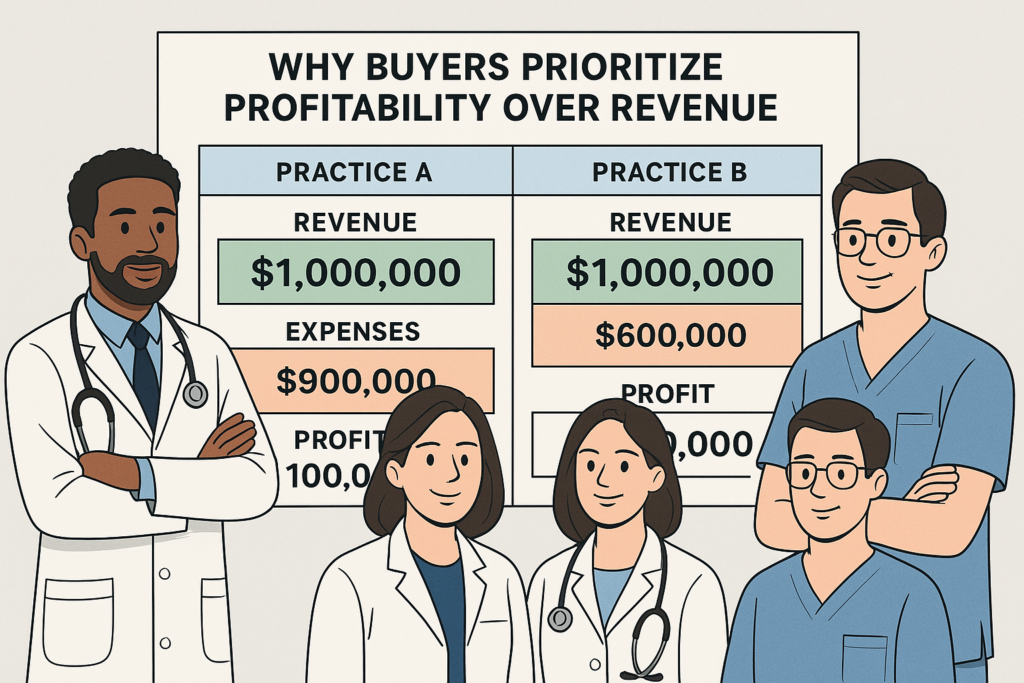

Now, here’s where it gets even more interesting: Two practices with identical revenue can have different valuations—all because of how much profit they generate. A buyer isn’t just looking for a high-grossing practice. They’re looking for a financially strong practice with sustainable earnings.

This is why understanding EBITDA vs. Revenue Multiples is not just helpful—it’s essential if you want to maximize your sale price. When the time comes to sell, you don’t want to just accept what’s offered—you want to negotiate from a position of strength.

So let’s break it down. How exactly do buyers value your practice? Why do EBITDA multiples hold so much weight? And more importantly, what can you do to ensure your practice commands the highest valuation possible?

The answers may surprise you—and they may just change the way you approach your exit strategy forever. Let’s dive in.

The Two Valuation Methods – What’s the Difference?

When it comes to selling your practice, understanding how buyers determine its value is non-negotiable. The wrong approach could leave you settling for far less than what your practice is truly worth.

There are two primary methods buyers use to calculate a practice’s value: Revenue Multiples and EBITDA Multiples. While both may seem logical at first glance, only one gives an accurate reflection of what your practice is actually worth. Let’s break them down.

1. Revenue Multiples: The Simplistic, Misleading Shortcut

Revenue multiples are the most commonly misunderstood valuation method. The formula is simple:

Revenue Multiple = Total Revenue × Industry-Specific Factor

For example, if similar practices in your field are selling for 1.5x revenue and your practice generates $2 million per year, you might assume your practice is worth $3 million (1.5 × $2M).

Sounds straightforward, right? But here’s the problem—this method ignores the one thing that matters the most: profit.

Why Revenue Multiples Are Misleading

Imagine two practices, both bringing in $2 million per year in revenue:

- Practice A keeps expenses low and generates $600,000 in profit annually.

- Practice B has higher overhead, higher payroll, and barely clears $100,000 in profit.

Would a buyer pay the same price for both practices? Of course not. Revenue alone doesn’t tell buyers how much money is being made.

Relying on revenue multiple overlooks factors like profitability, operational efficiency, and cash flow. It’s a shortcut—one that often leads sellers to overestimate their practice’s true worth.

2. EBITDA Multiples: The Real Deal for Serious Buyers

Let’s talk about what matters to buyers: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Unlike revenue multiples, which focus only on how much money comes in, EBITDA tells buyers how much money is left after operating expenses. In other words, it measures true profitability.

According to Statistica Research Department, the median value of enterprise value to earnings before interest, tax, depreciation and amortization (EV/EBITDA) in the health & pharmaceuticals sector as of 2025, was a multiple of approximately 19.3x.

Here’s why it’s the gold standard for practice valuation:

- It reveals how efficiently a practice operates. Buyers want to know how much profit they can expect—not just how much revenue flows through the business.

- It removes financial distortions. EBITDA strips out factors such as loan payments, taxes, and depreciation, giving buyers a clear, apples-to-apples comparison between different practices.

- It’s the number that buyers trust. Investors and private equity groups rely on EBITDA to determine if a practice is worth acquiring—and at what price.

If you’re thinking about selling, understanding EBITDA is essential. The stronger your EBITDA, the higher your valuation. And if you’re not paying attention to it now, you could be leaving money on the table.

According to Dental Economics, investors, buyers, and value analysts rely heavily on EBIT and EBITDA to compare apples to apples when assessing dental practices.

While practices may have different capital structures and be located in areas where taxation structures differ, applying EBITDA values allows for the normalizing of value metrics.

Now that you understand the difference, let’s take a deeper dive into how EBITDA multiples work—and why they determine what buyers are really willing to pay.

A Hypothetical Scenario – EBITDA vs. Revenue Multiples in Action

Let us walk through the story of two doctors, both running successful private practices. They have the same patient volume and revenue, and their businesses look identical on the surface. But when it comes time to sell, one doctor walks away with a huge payday, while the other gets an offer that’s a fraction of what he expected.

Why this difference?

Meet Dr. Smith and Dr. Holt

| Practice | Annual Revenue | Operating Costs | EBITDA (Profitability) |

| Dr. Smith’s Practice | $2M | $1.6M | $400K (20%) |

| Dr. Holt’s Practice | $2M | $1.9M | $100K (5%) |

Both doctors run thriving practices, generating $2 million in annual revenue. But when we take a closer look at their financials, their profitability tells a very different story: Both doctors bring in the same $2 million in revenue, but Dr. Smith keeps more of it as profit—$400K per year compared to Dr. Holt’s $100K.

Now, let’s apply two different valuation methods:

| Valuation Approach | Dr. Smith (High Profit) | Dr. Holt (Low Profit) |

| Revenue Multiple (1.5x Revenue) | $3M | $3M |

| EBITDA Multiple (6x EBITDA) | $2.4M | $600K |

At first, Dr. Holt assumes his practice is worth $3 million because he’s been told that practices sell for 1.5x revenue. But when a buyer evaluates his business using EBITDA, he’s in for a shock—the real offer comes in at just $600K.

Meanwhile, Dr. Smith—who has the same revenue but stronger profitability—gets a $2.4 million valuation. That’s four times more than Dr. Holt, all because he runs a more profitable operation.

The Reality Check: Why Buyers Care About EBITDA

Buyers aren’t paying for revenue—they’re paying for profit. Revenue alone doesn’t tell them how much cash the practice is generating. EBITDA, on the other hand, gives them a clear picture of financial health, operational efficiency, and long-term sustainability.

- Low EBITDA = Low Offers. No matter how high your revenue is, if profitability is weak, buyers won’t pay top dollar.

- Strong EBITDA = Premium Valuations. Buyers will pay more for a business that proves it can generate consistent profit.

- Ignoring EBITDA could cost you millions. If you’re focused only on revenue, you might massively overestimate your value—leading to disappointment when the real offers come in.

So, ask yourself: If you were a buyer, which practice would you invest in?

If you want to command the highest valuation, it’s time to shift your focus from revenue to profit. The question is—is your EBITDA strong enough to attract the right buyer?

How Buyers Assess Your Practice’s Value

Selling a practice isn’t as simple as naming a price and finding a buyer willing to pay it.

Serious buyers don’t just glance at your revenue—they dissect your financials, assess risks, and assign a valuation based on hard numbers, not guesswork.

If you don’t understand how they think, you can be caught off guard when the offers start rolling in.

So, how do buyers determine what your practice is worth? Let’s break it down step by step.

Step 1: Analyzing Financial Statements

Before a buyer even considers making an offer, they scrutinize your profitability, cost structure, and financial efficiency. They don’t just take revenue at face value. Instead, they ask:

- How much of the revenue turns into profit? A practice generating $2 million in revenue but keeping only $100K in profit is far less valuable than one with $1.5 million in revenue but $400K in profit.

- Are you overspending? Buyers dig into operating expenses to see if your practice is running efficiently. High payroll costs, excessive overhead, or bloated spending raise red flags, signaling financial instability.

- What expenses can be adjusted or removed? Many owners run personal expenses (cars, travel, family salaries) through the business. Buyers adjust for these “add-backs” to calculate the true earning potential—but only if they are properly documented.

At the end of this EBITDA vs. Revenue Multiples analysis, buyers have one key number in mind: EBITDA. Because at the end of the day, cash flow is king, and EBITDA is the ultimate measure of it.

Step 2: Assigning a Multiple Based on Risk and Market Factors

Once EBITDA is calculated, buyers determine how much they’re willing to pay for each dollar of profit. This is where multiples come into play.

- High-profit, well-run practices get premium multiples (6x-8x EBITDA). These are practices with strong profitability, solid management, and minimal owner reliance.

- Inefficient or owner-dependent practices get lower multiples (3x-5x EBITDA). If a practice can’t run smoothly without the owner, buyers see higher risk and lower value.

- Thin-margin or financially unstable practices get the worst deals (2x or less). If profitability is weak or inconsistent, buyers won’t pay top dollar.

At this stage, buyers aren’t valuing your revenue—they’re valuing your EBITDA and the risk attached to it.

Step 3: Adjusting for Buyer-Specific Risks

Even after assigning a multiple, buyers make final adjustments based on practice-specific risks. And once again, EBITDA is at the center of these decisions.

- If your practice is too dependent on you, the owner, the buyer sees a higher risk. If you step away and revenue drops, EBITDA takes a hit—so buyers lower the multiple.

- If your practice has strong management and stable revenue streams, it’s more attractive. A buyer is willing to pay more for a business that continues generating EBITDA regardless of ownership changes.

- If your EBITDA fluctuates too much, buyers hesitate. Consistency matters—a practice that earns $500K EBITDA one year and $200K the next will get a lower multiple than one that steadily generates $400K every year.

At the end of this process, buyers make their final valuation offer—one based not on your revenue dreams, but on your EBITDA reality.

The Bottom Line

If you want to command top dollar for your practice, you need to understand EBITDA and what drives valuation multiples. Buyers don’t care how much money flows into your business—they care about how much stays in it.

So the real question is: Are your numbers working for you or against you?

The Final Number That Truly Matters

Here’s the uncomfortable truth—your practice is only worth what a buyer is willing to pay. You can believe it’s worth millions, but if your EBITDA is weak, that dream evaporates the moment an offer lands on your desk. This isn’t about perception. It’s about numbers.

The good news? You have control. Your practice’s value isn’t set in stone—it’s a direct result of the decisions you make today. If you’re running a tight, profitable operation, you’re in the driver’s seat when it’s time to sell.

But if your expenses are eating away at your earnings, the market will punish you. Buyers don’t pay for potential—they pay for proven profitability.

And this is exactly where DiligenceSure changes the game. Instead of guessing what your practice is worth—or worse, relying on outdated revenue multiples—DiligenceSure gives you real-time, data-driven valuations based on what buyers actually pay.

It highlights value drivers, and ensures that when the time comes to sell, you’re negotiating from a position of strength.

So, what’s your next move? Are you going to wait until a buyer tells you what your practice is worth—or will you take control and make your practice worth what you deserve? The choice is yours.

But one thing is certain: only the doctors who understand EBITDA will walk away with the deal they want.

Ready to see where you stand? Let DiligenceSure show you the real value of your practice—before the buyers do.